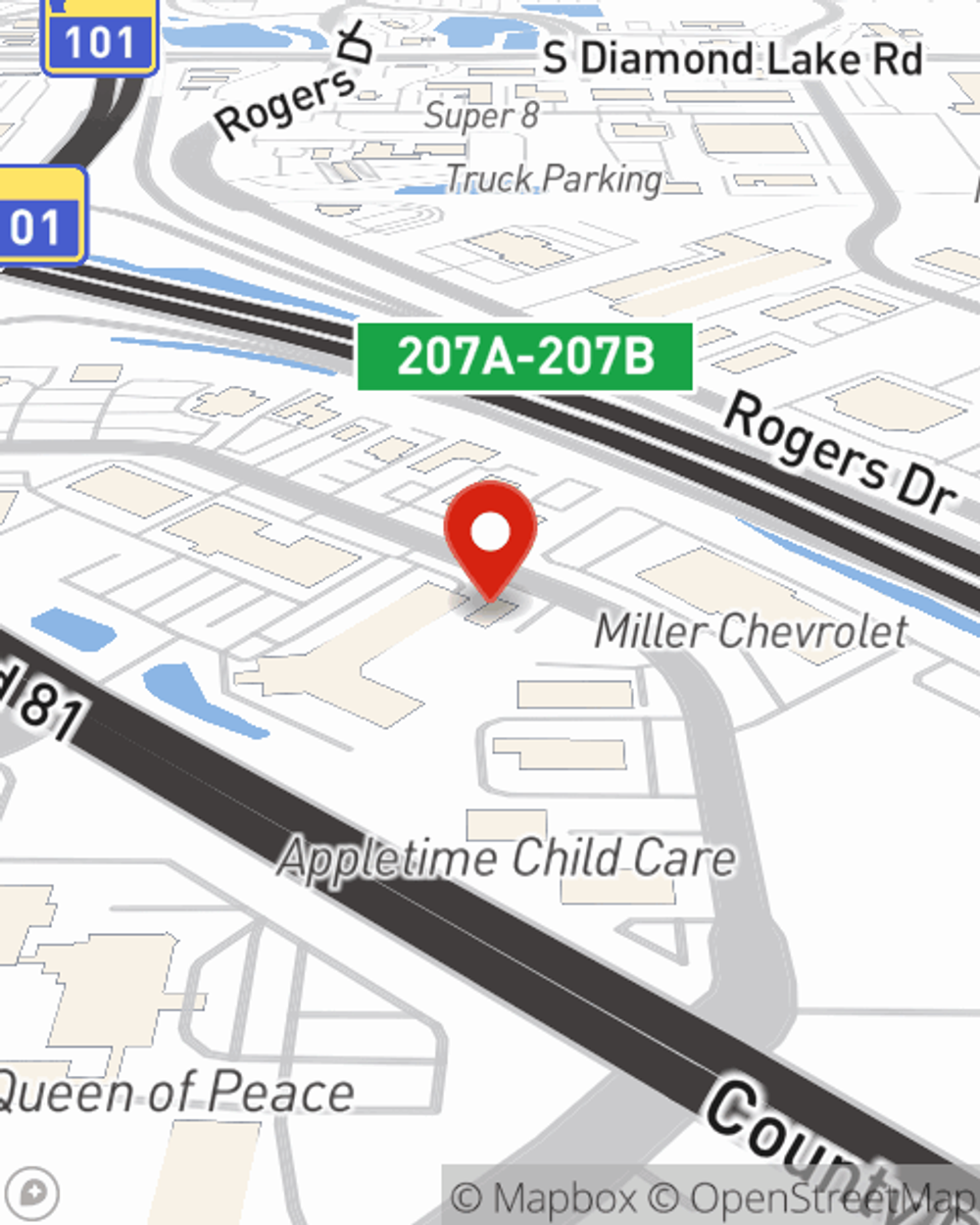

Business Insurance in and around Rogers

Looking for small business insurance coverage?

No funny business here

- Rogers

- St. Michael

- Otsego

- Maple Grove

- Hannover

- Dayton

- Elk River

- Plymouth

- New Hope

- Osseo

- Ramsey

Your Search For Excellent Small Business Insurance Ends Now.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Catastrophes happen, like an employee gets hurt on your property.

Looking for small business insurance coverage?

No funny business here

Protect Your Business With State Farm

Protecting your business from these potential accidents is as easy as choosing State Farm. With this small business insurance, agent Andy Hedlund can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Do what's right for your business, your employees, and your customers by visiting State Farm agent Andy Hedlund today to ask about your business insurance options!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Andy Hedlund

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.